- BOOK ME HERE

- About

- Giveaway Gift Rewards Contest

- ENROLL HERE

- Schedule For Our Personal Financial Development 1 Year Course

- The Challenge

- ELC SHOP CLUB

- Credit Repair and Financial Education Services

- Watch Our Business Presentation

- Contact

- FAQ

- Econ Learning Center Blog

- Terms of service

- Econ Learning Center Channel

- Credit Secrets Live Tv

- ELC Meta Verse Vr Fitness ED Games

Mastering Personal Finance with VR: A Step-by-Step Tutorial for Beginners

Introduction to VR in Personal Finance

Virtual Reality (VR) is transforming the way we engage with various aspects of our lives, including personal finance. This innovative technology offers an immersive experience, making complex financial concepts more accessible and understandable. By leveraging VR, beginners can gain a more tangible understanding of finances, enabling them to make informed decisions.

In this tutorial, we'll explore how you can master personal finance using VR, offering a step-by-step guide for beginners eager to take control of their financial future.

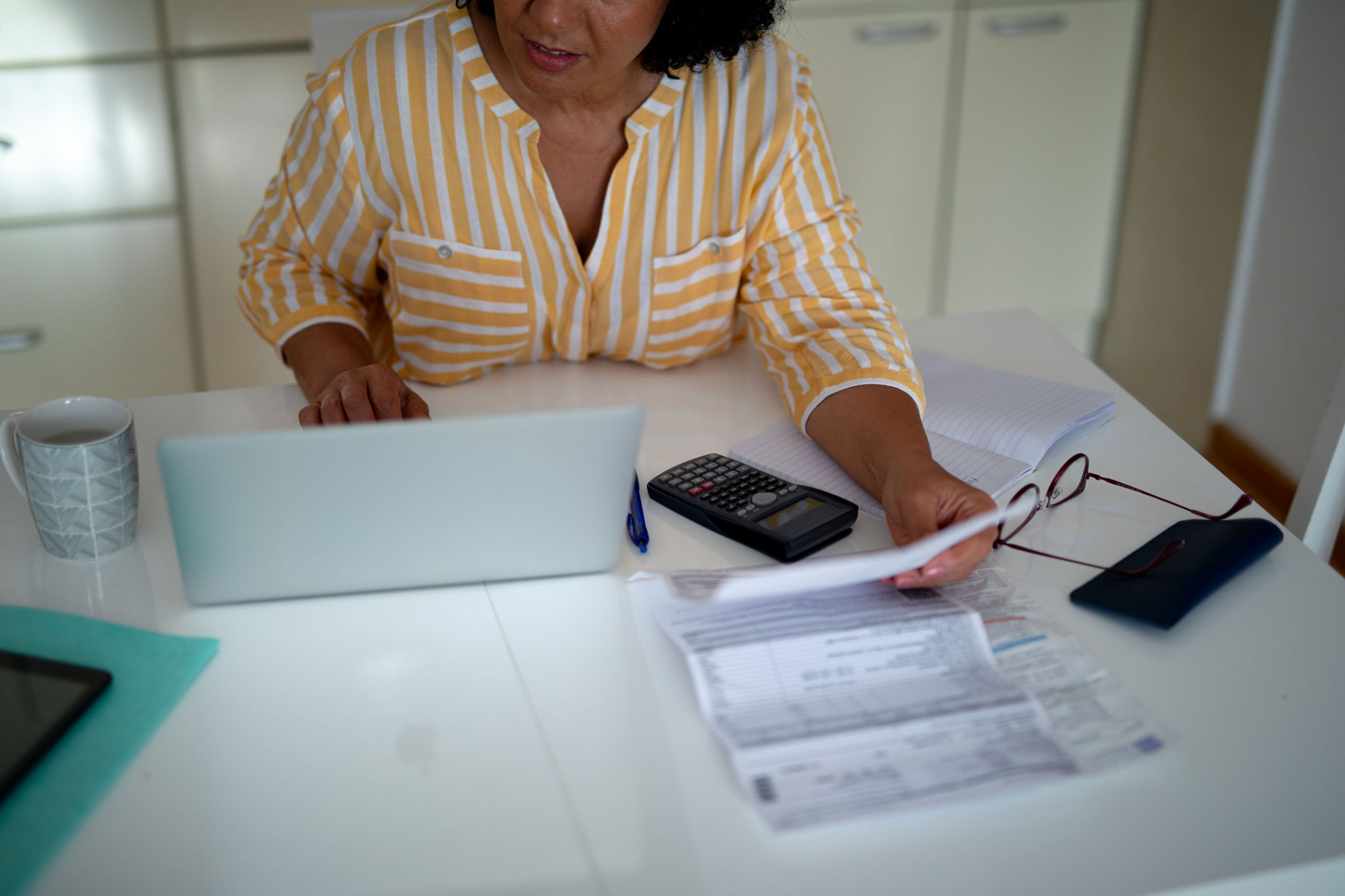

Understanding the Basics of Personal Finance

Before diving into the VR applications, it's crucial to understand the basics of personal finance. This includes budgeting, saving, investing, and debt management. A strong foundation in these areas will allow you to make the most of what VR has to offer.

Setting Financial Goals

Start by setting clear financial goals. Consider short-term, medium-term, and long-term objectives. Whether it's saving for a vacation, buying a home, or planning for retirement, having defined goals will guide your financial decisions.

- Identify your financial priorities.

- Set realistic timelines for each goal.

- Regularly review and adjust your goals as needed.

Exploring VR Applications for Finance

Several VR applications are designed to help users understand personal finance. These platforms offer interactive simulations that mimic real-world financial scenarios, such as managing a budget or investing in stocks. These simulations provide a risk-free environment to practice and hone your financial skills.

Budgeting in a Virtual World

VR can transform budgeting from a tedious task into an engaging experience. Users can visually allocate funds to different categories, track expenses in real-time, and receive instant feedback on their spending habits. This visual approach helps reinforce financial discipline.

Enhancing Investment Knowledge

Investing can be intimidating for beginners. VR simplifies this by offering virtual trading platforms where users can learn about stocks, bonds, and other investment vehicles without the risk of losing real money. This hands-on experience builds confidence and knowledge.

- Access to real-time market simulations.

- Interactive tutorials on investment strategies.

- Opportunities to experiment with virtual portfolios.

Managing Debt with VR

Debt management is another critical aspect of personal finance. VR applications can simulate debt repayment scenarios, helping users understand the impact of interest rates and the benefits of paying off debt faster. By visualizing these scenarios, users can develop effective strategies for managing their debts.

Conclusion: Embracing the Future of Personal Finance

As technology continues to evolve, VR stands out as a powerful tool in mastering personal finance. By providing an immersive and interactive learning environment, VR makes financial education more accessible and engaging for beginners. Embrace this technology, and take the first steps towards achieving financial literacy and independence.

Remember, the key to success in personal finance is continuous learning and adaptation. As you explore VR applications, stay curious and proactive in expanding your financial knowledge. The skills you develop today will pave the way for a secure financial future.